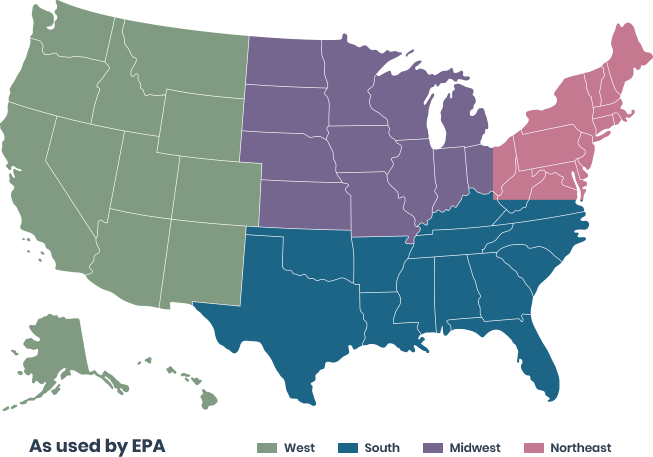

We will be looking for banks in each region defined by the EPA

Learn more about the benefits for your bank

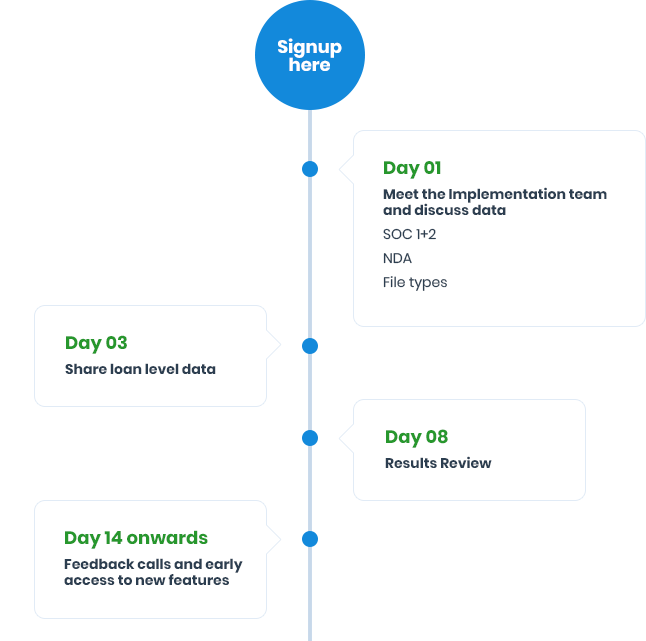

Join the GreenCap Accelerator

Policies towards an economic transition will impact every sector of the US economy from Agriculture to transport to buildings and energy. As the backbone of the US financial system, community banks will experience this impact first and most severely.

GreenCap is uniquely designed to provide liquidity scenarios built specifically around transitional policies. Banks can access GreenCap using the form above to see for themselves how their liquidity position will be impacted across a range of climate policy outcomes and test the reporting capabilities of GreenCap.

What are the benefits for my bank

Climate specific stress testing

scenarios not available in traditional

stress testing

View of the bank’s resiliency in the face

of climate related policies

Capacity to create contingency liquidity

planning against transitional policy

scenarios

What we need from your bank

Raw loan level data

(we'll take care of getting it mapped)

Meeting to review results and hear your feedback

Our Mission

Greenpoint’s mission is to bring low-cost, high-value, tier 1 quality software to community banks. Our view is that the strength of the US financial system relies on the diversity of local community banks, and we feel that they deserve access to the same quality of tools available to tier 1 banks when it comes to credit and liquidity risk.