Africa on the Frontline of Climate Change: Quantifying Sustainability Risk.

Your bank's climate credit risk assessment, right here.

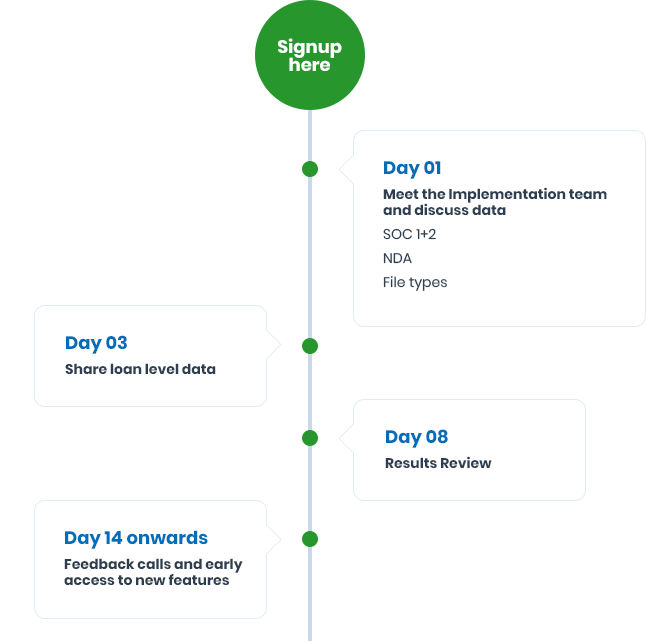

Join the GreenCap Accelerator

Policies designed to mitigate climate change through the regulation of GHGs create additional costs for banks in impacted industries. These costs have a knock-on effect on the business models and credit profiles of the banks. Lending officers and risk managers must ensure that any risk-related effects are understood and built into the risk management systems and processes.

GreenCap is a ‘Risk as a Service’ (RaaS) solution that enables banks to construct climate pathways as scenarios to be applied to their balance sheets. Industry and firm-level exposure to the policy routes is reflected within matrices that represent each scenario. The system allows scenarios to be fine-tuned in a way that captures the full spectrum of exposure, including the cross-border effects of BCAs, and hence provides a full 360-degree view of the financial risks that banks will need to deal with as we move through the green economic transition.

What we need from your bank

Raw loan level data

(we'll take care of getting it mapped)

Meeting to review results and hear your feedback

Africa on the Frontline of Climate Change:

Quantifying Sustainability Risk

Future-prepared stress testing

Transition risk assessment

Real numeric impact on liquidity

Our Mission

Greenpoint’s mission is to allow banks globally to incorporate sustainability risk in their financial strategy, and quantify their climate risk to future-proof. Banks in Africa are pivotal for the region’s growth – they deserve the tools specific to the region´s physical and transition risks. We want to provide the software that will enable diverse banks to include climate change as a category in their risk management frameworks and to ensure that their climate strategies are financially grounded.